SaaS LTV – Calculate, improve and track the core SaaS metric of them all

Building a successful SaaS business requires understanding and tracking the core metrics that impact profitability. One of the most important metrics is customer lifetime value, or LTV, which measures how much revenue an average customer will generate over their entire relationship with your company. An accurate and effective LTV calculation can provide invaluable actionable insights for SaaS founders looking to optimize their business model. In this post we'll discuss why it's essential to understand what LTV is, how you can calculate your own LTV as a SaaS business as well as some strategies to increase and improve your overall LTV within your existing structure.

SaaS LTV – why is it so important for SaaS startups

SaaS LTV, or Software as a Service Lifetime Value, is a crucial KPI for any SaaS business. This metric refers to the total amount of revenue that a customer is expected to generate during their entire lifetime as a user of the software. It takes into account not only the initial cost of acquiring a customer but also the recurring revenue that they generate over time through renewals and upsells.

SaaS LTV is so important because it helps businesses understand the financial value of each customer and enables them to make data-driven decisions about how to allocate resources and prioritize growth efforts. By tracking SaaS LTV, businesses can identify their most valuable customers and focus on retaining them, as well as targeting similar audiences for acquisition. Furthermore, tracking SaaS LTV helps businesses to optimize pricing strategies and improve customer acquisition and retention efforts, leading to long-term growth and profitability.

How to calculate your LTV as a SaaS

In the world of SaaS, there are few things as important as calculating your customer lifetime value (LTV). This metric serves as a key indicator of the health of your business and can help you make data-driven decisions about growth and investment. So, how do you calculate LTV?

To start, determine the average revenue per user (ARPU) and multiply it by the average customer lifespan (the amount of time a customer stays subscribed to your service). From there, subtract the customer acquisition cost (CAC). The resulting number is your LTV, a figure that represents the total value you can expect to receive from a single customer throughout their time with your business. By understanding and optimizing your LTV, you can ensure that your SaaS business is sustainable and successful for years to come.

Tips for improving your LTV as a SaaS

Maximizing the lifetime value (LTV) of customers is a key concern for any business looking to grow and thrive over the long-term. Fortunately, there are several strategies you can implement to boost your LTV, including pricing optimization and customer retention strategies.

By setting your prices at the right levels, you can encourage more purchases from your existing customer base and also attract new customers who are more likely to become loyal and return for repeat business. Retention strategies can include things like loyalty programs, personalized marketing, and excellent customer service. By making these investments in your customers, you'll build a stronger, more sustainable business that can continue to thrive well into the future.

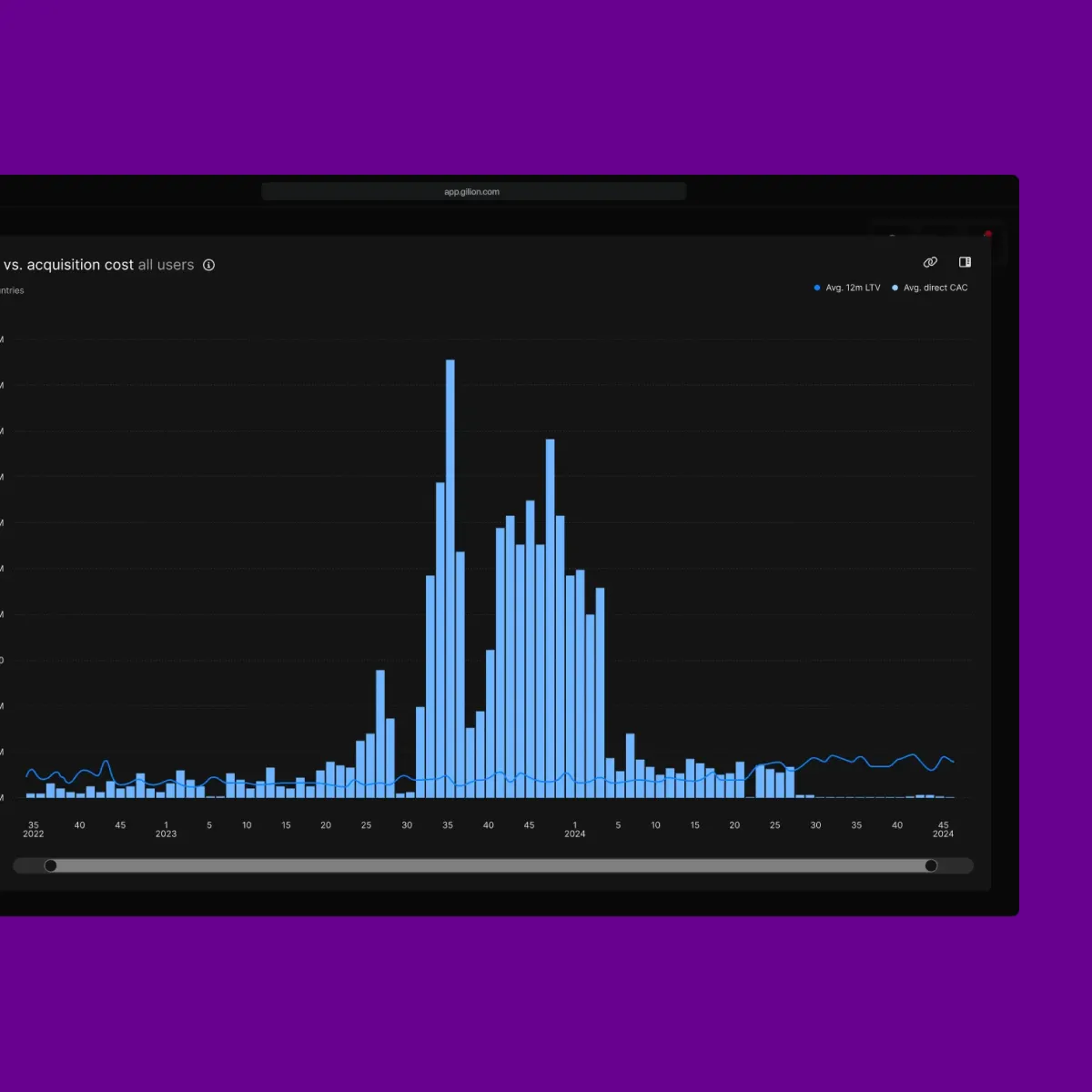

Tracking and analyzing your LTV

In order to truly understand how your business is performing, it's crucial to not only track your revenue, but also to analyze your customer lifetime value (LTV) over time. This metric measures the total worth of a customer to your business, and by monitoring it you'll be able to see how much your customers are truly worth to you.

By doing so, you can gain valuable insights into your customer base, which can help you make smarter decisions about marketing, customer retention, and product development. Whether you're just starting out or you've been in business for years, keeping an eye on your LTV is a key component of a healthy and thriving business.

Examples of successful SaaS companies that have used LTV-based strategies to scale their business

Software as a service () companies that have implemented a lifetime value (LTV) based strategy have seen tremendous success in scaling their business. One such company is Hubspot, which offers a suite of marketing, sales, and customer service tools.

By focusing on increasing LTV through cross-selling and upselling, Hubspot has consistently grown its customer base while retaining existing customers. Another example is Shopify, an e-commerce platform that offers online store management tools.

By using LTV strategies to optimize customer acquisition costs and customer retention, Shopify has experienced rapid revenue growth and is now valued at over $100 billion. These companies exemplify the power of leveraging LTV to fuel business expansion and sustain long-term success.

Best practices for staying ahead of the curve with your LTV metrics

Staying ahead of the curve in terms of LTV metrics is no easy feat, but it is crucial in order to remain competitive in today's ever-changing business landscape. To achieve this, businesses need to adopt best practices that enable them to stay informed about their customer behavior, identify trends and patterns, and take timely actions to optimize their LTV metrics.

This may involve utilizing advanced analytics tools, implementing personalized marketing strategies, regularly monitoring user engagement and retention rates, and continuously learning and adapting to changing market conditions. By doing so, businesses can gain a deeper understanding of their audience, improve customer satisfaction and loyalty, and ultimately drive profitability and long-term success.

Common questions on LTV for SaaS businesses

How do you calculate LTV as a SaaS business?

Calculating your lifetime value (LTV) as a SaaS business is essential for understanding the financial worth of each customer and optimizing growth strategies. To calculate LTV, start by determining the average revenue per user (ARPU) and multiply it by the average customer lifespan (the amount of time a customer stays subscribed to your service). Then subtract the customer acquisition cost (CAC). The resulting number is your LTV, which represents the total value you can expect to receive from a single customer throughout their time with your business.

What is a good LTV:CAC ratio for SaaS businesses?

A good LTV:CAC ratio for SaaS businesses is typically between 3:1 and 5:1. This means that the company's lifetime value should be at least three times greater than their customer acquisition cost in order to ensure sustainable growth.

Although this can vary depending on industry, keeping track of this ratio can give you a better understanding of your business’s financial health and provide insight into whether or not you are making smart investments in customer acquisition and retention.

Can you calculate LTV without knowing your churn?

Yes, you can calculate LTV without knowing your churn. But you shouldn't since it's not really reliable. But still better than nothing if you have an understanding of expected retention as a newly started business and still haven't got firm retention numbers.

To do this, start by calculating the average revenue per user (ARPU) and multiply it by the expected customer lifespan. Then subtract the customer acquisition cost (CAC). The resulting number is your LTV, which represents the total value of a customer over their time with your business. This method does not require knowledge of churn rate but will give you an estimate of how much money you can expect to make from each customer. While this number may be less accurate than one calculated with churn rate included, it is still a useful metric for understanding the financial health of your SaaS business.

What is a typical LTV for SaaS companies?

The typical LTV for SaaS companies is difficult to determine, as it varies drastically depending on industry and product type. However, generally the lifetime value of a customer should be at least three times greater than their customer acquisition cost (CAC) in order to ensure sustainable growth.

Businesses should strive to increase their LTV over time by implementing retention strategies, such as loyalty programs and personalized marketing experiences. By focusing on increasing LTV metrics, SaaS businesses can gain valuable insights into their customer base and better understand how they can optimize growth and profitability.

How far into the future should you look at SaaS fees when calculating LTV?

When calculating lifetime value (LTV) for SaaS businesses, it is important to look far into the future. Generally, a good rule of thumb is to look at least three years out when predicting revenue and costs associated with your customer base. This will give you an idea of how much money you can expect to make from each customer and what areas may need improvement in order to maximize profitability.

Projecting LTV over time periods greater than three years can provide valuable insight into long-term trends that may affect your business in the future. By monitoring these metrics regularly, you can ensure that your SaaS business remains competitive and profitable well into the future.