LTV : Calculation, explanation & importance for startups

LTV or lifetime value is the estimated net profit attributed to the entire future relationship with a customer. In other words, it's a measure of how much revenue a single customer can bring in over the course of their relationship with your company. LTV is a important metric for startups because it allows them to predict and track profitability and growth.

The meaning of LTV

LTV or Lifetime Value is a metric that startups use to determine the value of a customer. The goal is to maximize LTV while acquiring customers at a low cost. There are a few ways to calculate LTV, but the most common is to take the gross margin from a customer and divide it by the churn rate.

For example, if a customer has a 20% gross margin and the annual churn rate is 5%, then the LTV would be 4%. To put it simply, LTV is the amount of revenue that a startup can generate from a customer over the lifetime of their relationship.

A high LTV is essential for startups because it allows them to reinvest in acquisition and growth. If you're able to acquire customers cheaply and keep them around for years, then you're in a good position to scale your business.

Why LTV is an important metric for startups to track

Startups live and die by their ability to acquire and retain customers. That’s why Lifetime Value (LTV) is such an important metric for startups to track. LTV is a measure of the total value a customer will bring to a business over the course of their relationship startups need to focus on acquiring high-value customers with a long shelf life.

By understanding their LTV, startups can make more informed decisions about where to allocate their limited resources. They can also use LTV to benchmark their performance against other businesses in their industry. In short, LTV is a key metric that startup founders should keep their eye on. LTV is among SaaS companies seen as one of the most important metrics to track.

How to calculate LTV

There are a few different ways to calculate LTV, but the most common is to take the gross margin from a customer and divide it by the churn rate. For example, if a customer has a 20% gross margin and the annual churn rate is 5%, then the LTV would be 4%. To put it simply, LTV is the amount of revenue that a startup can generate from a customer over the lifetime of their relationship. A high LTV is essential for startups because it allows them to reinvest in acquisition and growth. If you're able to acquire customers cheaply and keep them around for years, then you're in a good position to scale your business.

The most common LTV formula used by startups

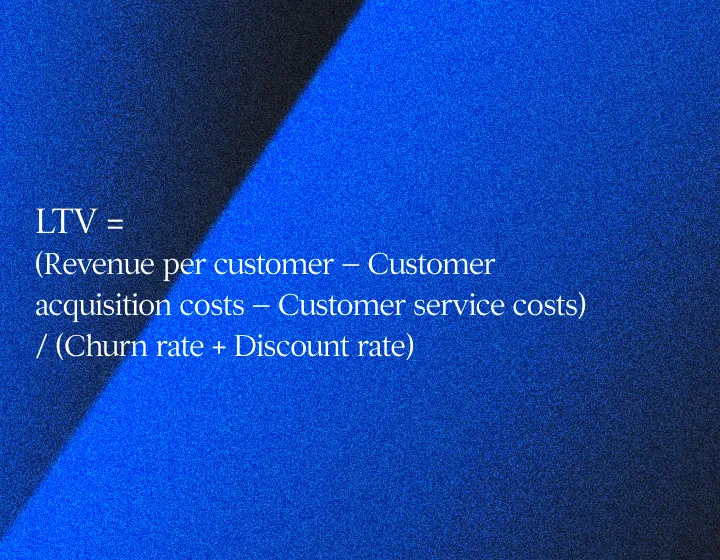

The lifetime value of a customer (LTV) is the estimated net profit attributed to the entire future relationship with a customer. The net profit is calculated by subtracting the costs of acquiring and servicing the customer from the revenue generated from the customer. The formula for calculating LTV is:

LTV = (Revenue per customer – Customer acquisition costs – Customer service costs) / (Churn rate + Discount rate)

This formula can be used to estimate the value of a customer over their lifetime with a company. It is important to consider all costs associated with acquired and servicing customers when estimating LTV, as these costs can eat into profits. The churn rate and discount rate are also important factors to consider, as they can impact the estimated longevity of a customer relationship.

By accurately estimating LTV, companies can make informed decisions about how to invest in acquiring and servicing customers.

Calculate & forecast LTV it more accurately with AIM

At Gilion we have developed our analytics too where you can with precision measure and forecast LTV.

Why LTV is important to know when setting your targets

The LTV formula can also be used to help startups determine how much money they should be spending on acquiring new customers. Startups need to balance the costs of customer acquisition with the revenue generated from those customers. If a startup is spending more on acquiring customers than they're generating in revenue, then they're not going to be sustainable in the long run. However, if a startup can acquire customers cheaply and generate a high LTV from them, then they're in a good position to scale their business.

To calculate how much you should be spending on customer acquisition, you can use the following formula:

Customer Acquisition Cost = LTV / (1 – Churn Rate)

This formula will give you the maximum amount you can spend on acquiring a new customer without losing money in the long run. Of course, you'll still need to generate revenue from those customers to make your business sustainable. But if you can keep your customer acquisition costs low and your LTV high, then you're in a good position to scale your business.

LTV can also help you decide when it's time to start monetizing your product

Another important use case for LTV is to help startups decide when it's time to start monetizing their product. Startups often delay monetization until they have a large number of users, but this can be a mistake. If a startup has a high LTV, then they can start monetizing sooner and still generate significant revenue.

To calculate how much revenue you need to generate from each customer, you can use the following formula:

Revenue per Customer = LTV / (1 – Churn Rate)

This formula will give you the minimum amount of revenue you need to generate from each customer to make your business sustainable. If you're able to generate more than this amount from each customer, then you're in a good position to scale your business.

Tips on how you can increase your LTV

There are a few key things you can do to increase your LTV. First, you need to focus on acquiring high-quality customers who are likely to stick around for the long term. Second, you need to invest in customer retention and loyalty programs to keep those customers coming back. And third, you need to make sure you're accurately calculating your LTV so that you're making informed decisions about how to grow your business.

If you can keep your customer acquisition costs low and your LTV high, then you're in a good position to scale your business. By accurately estimating LTV and focusing on acquiring and retaining high-quality customers, startups can position themselves for long-term success.

When calculating your company's LTV, there are a few important questions you need to answer:

1. How much revenue does each customer generate?

2. What are the costs of acquiring and servicing customers?

3. What is the churn rate for your company?

4. What is the discount rate for your company?

By answering these questions, you'll be able to accurately calculate your company's LTV and make informed decisions about how to grow your business.

LTV is an important metric for startups because it allows them to reinvest in acquisition and growth. If you're able to acquire customers cheaply and keep them around for years, then you're in a good position to scale your business. The most common use cases for LTV are to help startups determine how much money to spend on customer acquisition and when it's time to start monetizing their product. By accurately estimating your company's LTV, you can make informed decisions about how to grow your business.

Lifetime value is a critical metric for startups. It allows them to make informed decisions about how to acquire and service customers. LTV also provides a roadmap for when it's time to start monetizing your product. If you can keep your LTV high and your customer acquisition costs low, then you're in a good position to scale your business.

Common questions on LTV

What is LTV and why is it important?

Lifetime value (LTV) is the total revenue that a customer will generate for your company over the course of their relationship.

LTV is an important metric for startups because it allows them to make informed decisions about how to acquire and service customers. LTV also provides a roadmap for when it's time to start monetizing your product.

What are the factors that go into calculating LTV?

There are a few key factors that go into calculating LTV: customer acquisition costs, customer churn rate, and the discount rate. By taking these factors into account, startups can accurately estimate their LTV and make informed decisions about how to grow their business.

How can you make sure that your LTV is as high as possible?

There are a few key things you can do to make sure your LTV is as high as possible: focus on acquiring high-quality customers, invest in customer retention and loyalty programs, and make sure you're accurately calculating LTV. By doing these things, you can position your startup for long-term success.